Decode the stock's slump from a valuation perspective

| Where is Vietnam on the upgrade of securities market? | |

| Taking many measures to encourage enterprises to list on the stock market | |

| Many stocks face the risk of being forced to leave the stock exchange |

|

| Adjustment to a lower price rate is necessary for the sustainable growth of the stock market. Photo N.Hiền |

Valuation at record high rate

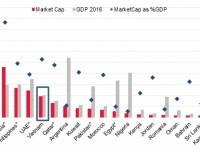

Before November 2017, Vietnam Securities traded on the P / E (price /earnings ratio) basis (the ratio between market price and net earnings per share) at quite a low level, an average of 14.2 times. In the last 5 years, P/E of VN-Index has fluctuated in the range between 10.8 times and 17.4 times and has been always lower than other countries in the region. This price rate is reasonable when Vietnamese stock market still has a small scale.

However, the rapid and strong growth from the end of 2017 has pushed valuation to a high rate. With the whole market’s growth rate of 23% in 2017, VN-Index increased by 48% in 2017 and rose more than 22% in only first three months. So, P / E valuation has been pushed up to a higher rate than historic rates, reaching 21.5 times and surpassing the US market (20.2 times) and other countries in the region.

With leading positions in the sector, the key stocks are priced at a higher rate than the general market. Average P / E of the top three big securities reached 29.4 times, notably VIC, ROS and VRE have a PE of over 50 times.

The banking sector has a very low P / E, but the P/ B (price-to-book ratio )valuation (the ratio used to compare a stock market value to its book value) is also higher than stocks of banks in the world. P/B of VCB peaked at 5 times while the average ratio of banking stocks was about 1.5 times. Similarly, P / B of many other banks such as BID, VPB, HDB and ACB also exceeded the ratio by 3 times.

SSI's experts assessed that, in that situation, the adjustment to a lower price rate is completely reasonable and necessary for the sustainable growth of the stock market.

After a deep fall, by the end of April 2018, the P / E of the VN-Index has returned to 18.7 times, equal to the ratio at the end of 2017. Vietnam's market valuation has also been brought close to other countries in the region such as Thailand (18 times), Malaysia (17.5 times).

With profit growth of 22.8% in the first quarter of 2018, PEG (Price/Earnings To Growth - PEG Ratio) (the ratio used to determine a stock's value while taking the company's earnings growth into account) of the Vietnamese market is 0.82 times, which is quite reasonable compared with PEG of the US market of 1.15 times with an expected profit growth for 2018 of 17.7%.

However, if considering carefully, the profit growth of 22.8% is not common. Market growth is heavily dependent on the banking and stock sectors with a number of positive supporting factors for 2018. If excluding these two sectors, the overall growth was only around 10%.

Many sectors still have low and negative growth, including consumer goods such as VNM, SAB, real estate and construction such as NVL, ROS, CTD, TDH and VGC. The profit results of the next quarters should be further improved to create a solid foundation for market growth.

Foreigners are net sellers

Regarding the trading of foreigners, foreign investors sold a net of VND 3,000 billion in April and VND 1.8 trillion in just 3 days after the holiday (30th April and 1st May). Since February, foreigners have been net selling VND 8,400 billion, higher than net purchase of VND 5,300 billion in January.

"When the excitement of the market rises, the reversal of foreign capital flow has not been much noticed by domestic investors. However, when foreigners were net sellers for 3 consecutive months, domestic investors have finally realized the influence of this capital inflow," the SSI report showed.

The stock of highest net selling in April was real estate with VIC being sold at VND 2,100 billion. This may be one of the reasons that make the biggest capitalization stocks decline, putting pressure on the general market. Apart from VIC, the strong net-selling trend was also reflected in many other key stocks such as VCB, VJC, NVL and MSN.

It is difficult to explain why foreigners increased such net selling in April. According to SSI, it can be easily seen that the net selling trend has appeared in early February when the world’s stock market slumped and the world’s economy and interest rates changed when the US President Donald Trump has drastically enforced policies that protect the US businesses. The Fed might raise interest rates faster than expected and the risk of a widespread commercial war would have affected the decision of foreign investors. In addition, the addition of big capitalized IPO stocks and listing may also lead to restructuring of the portfolio of foreign funds.

| Where is Vietnam on the upgrade of securities market? VCN- Currently, 5 Vietnam’s shares meet the requirements of MSCI (the prestige provider of analytical tools of ... |

Contrary to the net selling trend on the exchanges by foreign investors, money flow in ETF funds are showing more positive signs. VFM VN30 fund was no longer withdrawn and instead increased from late April and continuously increased in early May. VanEck fund was withdrawn in discontinuous manner. In April, ETF added VND 107 billion, which reversed its capital flow after a withdrawal of more than VND 930 billion in March.

| 2018 is still expected to be a successful year for the banking sector. Net profit in the first quarter of 2018 of 12 listed banks increased by 51.6% over the same period last year, higher than the growth rate of 36% in 2017, of which some banks have increased 2-3 times such as ACB, HDB, TPB and EIB. Leading banks also gained an impressive growth such as VCB increased by 58.7%. Thanks to the banking sector, total net profit rose by 22.9% in the first quarter of 2018. Some large enterprises such as VIC, MSN, VJC and the stock sector also see a high growth |

Related News

Central bank starts huge credit package for social housing projects

14:42 | 04/04/2023 Finance

Nearly 400 complaints about insurance distribution through banks on Ministry of Finance hotline

14:47 | 04/04/2023 Finance

Central bank cuts policy interest rates to spur growth

17:43 | 02/04/2023 Finance

Need to effectively use tools to prevent exchange rate risks in import and export field

10:32 | 02/04/2023 Import-Export

Latest News

Corporate bonds worth 1.1 billion USD issued in March

13:55 | 06/04/2023 Finance

Tax revenue is estimated at VND 426,922 billion in the first quarter

09:56 | 06/04/2023 Finance

In Q1, State revenue estimated to rise by 1.3%

13:28 | 04/04/2023 Finance

Consider raising the level of penalties to ensure fairness and transparency in the stock market

13:27 | 04/04/2023 Finance

More News

Ensure policies to attract investment when implementing global minimum tax

10:33 | 02/04/2023 Finance

SBV asks to issue revised decree on foreign ownership cap at Vietnamese banks

20:30 | 01/04/2023 Finance

Solutions to attract FDI when implementing the global minimum CIT

11:38 | 01/04/2023 Finance

Effective implementation of tax incentives as driving force for growth in trade turnover between Vietnam and Cuba

13:43 | 31/03/2023 Finance

Being many "hot" issues at the general meeting of shareholders of banks

09:24 | 30/03/2023 Finance

Bringing the policies on reducing land rent and water surface rent into life

15:41 | 29/03/2023 Finance

The more delayed the investment disbursement is, the more accumulated the capital expenditure will be

10:22 | 29/03/2023 Finance

Ministry of Finance summarizes the 10-year implementation of the Resolution of the 8th meeting of the 11th Central Committee

10:20 | 29/03/2023 Finance

Deputy PM urges hastened procedures for cancelled IDA loans

14:25 | 28/03/2023 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Corporate bonds worth 1.1 billion USD issued in March

13:55 | 06/04/2023 Finance

Tax revenue is estimated at VND 426,922 billion in the first quarter

09:56 | 06/04/2023 Finance

Nearly 400 complaints about insurance distribution through banks on Ministry of Finance hotline

14:47 | 04/04/2023 Finance

Central bank starts huge credit package for social housing projects

14:42 | 04/04/2023 Finance

In Q1, State revenue estimated to rise by 1.3%

13:28 | 04/04/2023 Finance