Security crucial in the digital transformation process

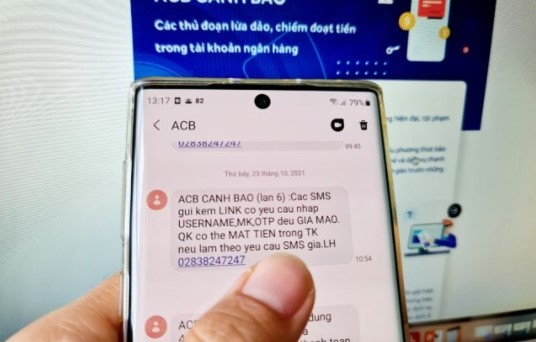

A text message from a bank warns about fraudulent links which may steal money from the users' accounts. Enhancing network information security and safety was a crucial factor in the digital transformation process. — Photo nld.com.vn

Enhancing network information security and safety was a crucial factor in the digital transformation process, the Vietnamese Network Security Joint Stock Company (VSEC) has said, warning that phishing attacks targeting the financial and banking industry might increase.

In a recent report, VSEC said that ransomware attacks, silent attacks on technology apps and attacks in the financial and banking industry were three major trends this year.

Ransomware attacks increased sharply in 2021 and would continue to do so, VSEC said, adding that ransomware infections had spread rapidly due to the growth of online learning and working platforms.

According to statistics by Cybersecurity Ventures, ransomware attacks caused an average loss of around US$102.3 million per month globally. In Việt Nam, the number of computers attacked by data encryption viruses in 2021 was more than 2.5 million, 4.5 times higher than 2020, according to a survey by Bkav. Most users were still confused and did not know how to respond when their computer was infected with malware.

The digital transformation process in Việt Nam has witnessed many remarkable achievements but to develop sustainably, the process must go hand in hand with information security, VSEC said, warning that many organisations and businesses had not paid adequate attention to ensuring network information security and safety, which created holes for hackers to spread ransomware.

VSEC also pointed out that silent attacks on technology apps would also be a trend as the COVID-19 pandemic had forced a number of businesses to digitalise to operate and serve customers, leading to increased demand for technology apps. The design and launch of apps without adequate investment in information security would make users easy prey for hackers.

Phishing attacks have been on the rise since last year and continue to be a big threat to organisations and businesses, especially those in the banking and finance industry.

The COVID-19 pandemic had led to a sharp increase in the demand for online transactions and payments, creating room for hackers to target online banking services and e-wallets, VSEC said.

Phan Chung Thủy from the University of Economics HCM City cited Karpersky’s findings that Việt Nam ranked 21st in the world with more than 670,000 phishing attacks in 2020.

A survey by the Việt Nam Information Security Association showed that more than 50 per cent of attacks targeted financial and banking institutions.

Thủy said that banks must pay special attention to information security during the digital transformation process.

VSEC said that attacks would continue to increase in 2022 as awareness about information security of many users remains limited. Maintaining network information security monitoring and security testing would help enterprises and organisations to respond quickly when an incident occurred.

Previously, the Authority of Information Security under the Ministry of Information and Communications said that phishing attacks were the main trend in cyberattacks this year, besides targeted attacks to spread malicious code in order to obtain control of Internet of Things devices such as cameras and attacks on cloud platforms.

The ministry’s statistics showed that more than 1,000 fraudulent websites were handled during the past year. The department also provided warnings about fraudulent websites to users at the address canhbao.ncsc.gov.vn. — VNS

Related News

Manufacturing enterprises increase their competitiveness thanks to digital transformation

13:28 | 04/04/2023 Import-Export

Việt Nam, US hold 12th political, security, defence dialogue

14:15 | 03/04/2023 Headlines

Public investment to be the foundation for the development of the stock market

10:11 | 28/03/2023 Import-Export

PM urges basic, comprehensive reform in digital transformation

19:47 | 25/02/2023 Headlines

Latest News

Corporate bonds worth 1.1 billion USD issued in March

13:55 | 06/04/2023 Finance

Tax revenue is estimated at VND 426,922 billion in the first quarter

09:56 | 06/04/2023 Finance

Nearly 400 complaints about insurance distribution through banks on Ministry of Finance hotline

14:47 | 04/04/2023 Finance

Central bank starts huge credit package for social housing projects

14:42 | 04/04/2023 Finance

More News

In Q1, State revenue estimated to rise by 1.3%

13:28 | 04/04/2023 Finance

Consider raising the level of penalties to ensure fairness and transparency in the stock market

13:27 | 04/04/2023 Finance

Central bank cuts policy interest rates to spur growth

17:43 | 02/04/2023 Finance

Ensure policies to attract investment when implementing global minimum tax

10:33 | 02/04/2023 Finance

SBV asks to issue revised decree on foreign ownership cap at Vietnamese banks

20:30 | 01/04/2023 Finance

Solutions to attract FDI when implementing the global minimum CIT

11:38 | 01/04/2023 Finance

Effective implementation of tax incentives as driving force for growth in trade turnover between Vietnam and Cuba

13:43 | 31/03/2023 Finance

Being many "hot" issues at the general meeting of shareholders of banks

09:24 | 30/03/2023 Finance

Bringing the policies on reducing land rent and water surface rent into life

15:41 | 29/03/2023 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Corporate bonds worth 1.1 billion USD issued in March

13:55 | 06/04/2023 Finance

Tax revenue is estimated at VND 426,922 billion in the first quarter

09:56 | 06/04/2023 Finance

Nearly 400 complaints about insurance distribution through banks on Ministry of Finance hotline

14:47 | 04/04/2023 Finance

Central bank starts huge credit package for social housing projects

14:42 | 04/04/2023 Finance

In Q1, State revenue estimated to rise by 1.3%

13:28 | 04/04/2023 Finance