To reduce 30% of samples subject to analysis, classification and assessment

|

| Customs officers carry out sample assessment. Photo: N.Linh |

Regarding the administrative procedure reform and reduction of customs clearance time,customs units are equipped with machines and equipment for physical inspection, cargo monitoring (container scanners, luggage scanners, cargo; surveillance camera systems and seal positioning). This is the regular task of the units under and attached to the General Department of Customs.

At the same time, customs units consider abolishing the implementation of administrative procedures on the online public service portal if they have been done on the e-Customs data processing system; abolish the proposal and approval for tax exemption in customs clearance for each customs declaration of the customs regime of export processing and production in the process of tax exemption, tax reduction, tax refund, non-tax collection; guide the delivery of goods under customs supervision if the delivery is carried out at the same customs branch.

In addition, the General Department of Customs' plan also requires a 30% reduction in the number of samples subject to analysis, classification and assessment. The time for notification of analysis and classification results must be in accordance with Circular No. 14/2015 / TT-BTC dated January 30, 2015 of the Ministry of Finance; the rate of samples informed of analysis and classification results before the due date and at the due date is 90%.

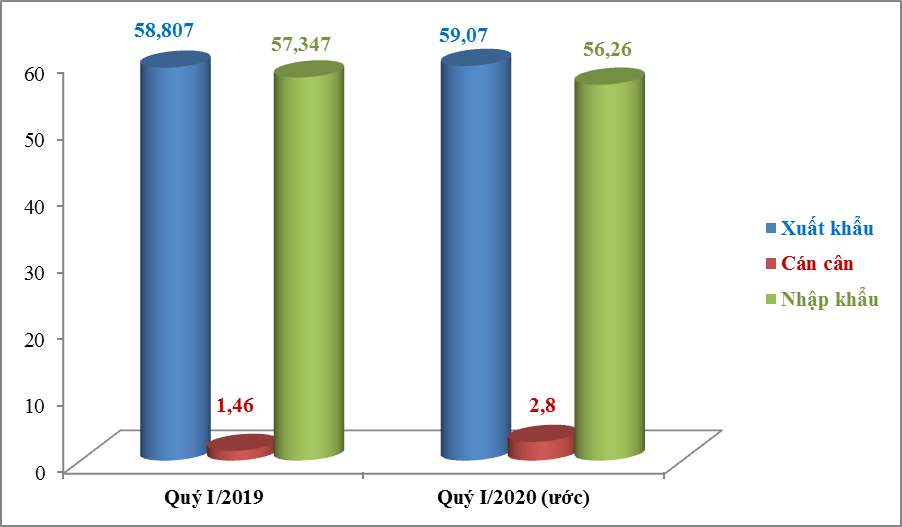

| Reaching more than US$115 billion, the scale of import and export decreased compared to the same period in 2019 VCN- The latest information of the General Department of Customs shows the import-export turnover of the country ... |

In particular, the General Department of Customs also set requirements for the channel classification rate of customs declaration, reducing the rate of Yellow and Red channels, while increasing the rate of Green channel. The customs declaration rate subject to Red channel is below 4.5%, Yellow channel below 30%, and Green channel over 65%.

Related News

Difficulties in determining samples for testing

09:32 | 26/03/2023 Regulations

Rectify price appraisal enterprises

09:21 | 21/02/2023 Finance

Separate handling measures will be applied for each subject of a tax debt via classification

09:59 | 17/10/2022 Finance

Piloting support for enterprises voluntarily complying with Customs Law

15:37 | 25/07/2022 Customs

Latest News

Enterprises have the right to pre-determine HS codes

09:55 | 06/04/2023 Regulations

Amendment to Decree 14 to prevent goods congestion at border gates

11:39 | 01/04/2023 Regulations

Notes for businesses on tax policy

13:44 | 31/03/2023 Regulations

Revising Law on Corporate Income Tax: Promoting resources for socio-economic development

13:43 | 27/03/2023 Regulations

More News

Apply 609 preferential export tax lines, 11,526 special preferential import tax lines to implement the CPTPP Agreement

09:33 | 26/03/2023 Regulations

GDVC instructs application of C/O form D

10:16 | 25/03/2023 Regulations

Goods imported from export processing enterprises must pay tax

09:03 | 24/03/2023 Regulations

Review, perfect regulations on decentralization of public property management

11:55 | 22/03/2023 Regulations

MoF develops excise tax policy to promote electric vehicle production

17:21 | 13/03/2023 Regulations

Enterprises must submit dossiers and documents to identify authenticity of goods' value

10:09 | 13/03/2023 Regulations

Removing difficulties in the implementation of VAT policy

15:10 | 27/02/2023 Regulations

Correcting policy to avoid overlaps in inspection and supervision at land border gates

14:13 | 26/02/2023 Regulations

Tax policy for re-imported goods of export processing enterprises

14:43 | 23/02/2023 Regulations

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Enterprises have the right to pre-determine HS codes

09:55 | 06/04/2023 Regulations

Amendment to Decree 14 to prevent goods congestion at border gates

11:39 | 01/04/2023 Regulations

Notes for businesses on tax policy

13:44 | 31/03/2023 Regulations

Revising Law on Corporate Income Tax: Promoting resources for socio-economic development

13:43 | 27/03/2023 Regulations

Apply 609 preferential export tax lines, 11,526 special preferential import tax lines to implement the CPTPP Agreement

09:33 | 26/03/2023 Regulations